Seasonal workloads, reduced investments in building construction, and ongoing public-health measures to control the spread of COVID-19 combined to lower construction employment in January.

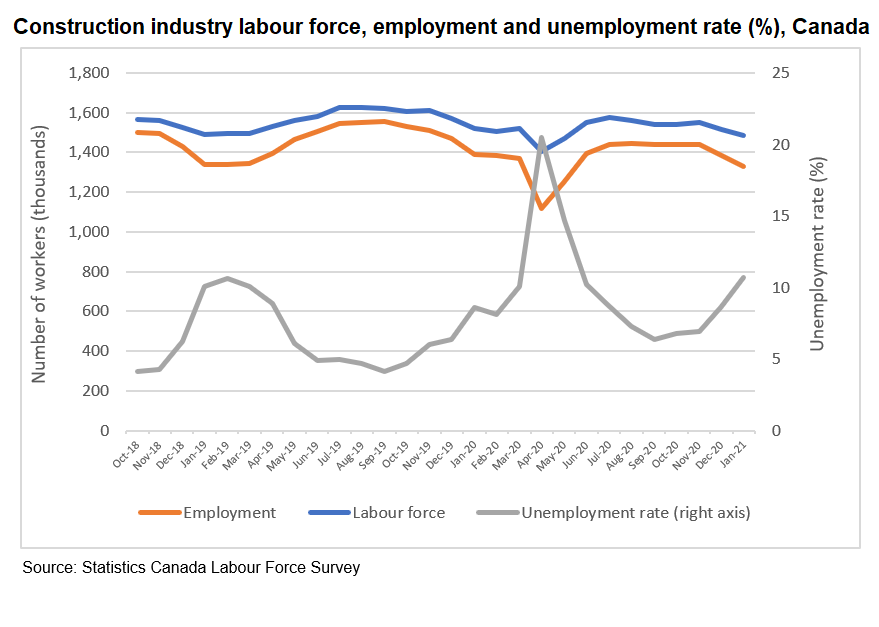

Data from Statistics Canada’s Labour Force Survey (LFS) for the month, which was collected during the week of January 10 to 16, show an industry-wide drop of 56,300 workers on an unadjusted basis. January 2021’s total industry employment of 1.328 million is a decline in employment of 4.1% compared with the month previous, and a drop of 4.2% – or about 58,100 workers – compared with January 2020.

January’s employment decline is not unexpected. Construction’s seasonal nature usually means that work on infrastructure projects such as roads, highways, and bridges pauses during the coldest months of the year. As well, Ontario and Quebec went into lockdowns in late December, which further limited some construction activities.

And while these trends were expected in January’s labour force study, more troubling perhaps is that investment in building construction has been on a steady downward trend for the last five months of 2020.

On an unadjusted basis, overall investment peaked at $17.8 billion in August 2020 but has since declined over the past five months to $15.6 billion in December. Although it is unclear to what extent these investment reductions will affect construction employment, the downward investment trend suggests some weakness in the market leading into 2021.

Largest industry employment losses in Atlantic provinces

The largest month-over-month percentage declines in construction employment were recorded in New Brunswick (-20.8%), followed by Newfoundland and Labrador (-9.3%) and Ontario (-6.9%). Most other provinces recorded losses of 5% or less. Alberta (+1.1%) was the only province to report a gain in employment.

As a consequence, the industry unemployment rate increased nationally to 10.7% in January – up from the 8.7% recorded in December.

Provincial construction industry unemployment rates were highest in Newfoundland and Labrador (30.3%), and New Brunswick (25.4%). In the case of Newfoundland and Labrador, the rate was down slightly from December. New Brunswick, however, recorded a rise of more than 7 percentage points in its monthly unemployment rate.

Recording increases in year-over-year unemployment were Prince Edward Island, Quebec, Ontario, Saskatchewan, and British Columbia. Newfoundland and Labrador, Alberta, Manitoba and Nova Scotia, meanwhile, recorded lower unemployment rates in January than the same period in 2020.

Labour force, hours worked down

Construction’s overall labour force declined by 31,700 workers (-2.1%) in January from the same period last year. That brings the number of workers in the sector’s labour force down from the 1,518,400 recorded in January 2020 to 1,486,700 in January 2021.

The largest year-over-year labour force decline was evident in British Columbia, which shed 28,100 workers (-11%). Alberta and Nova Scotia, on the other hand, saw sizeable increases. Their respective labour forces rose by 10,400 (+4.5%) and 1,900 (+5.2%) workers.

Finally, total hours worked continued to decline into January (-8%). That figure, however, was only 1% below January 2020 levels.

The loss in hours worked moderated in Newfoundland and Labrador in January, which has seen significant declines in hours worked since the start of the pandemic. New Brunswick saw a steep decline in hours worked in January, reporting 27% fewer hours compared to December and 23% fewer hours year-over-year.

Conversely, hours worked in Alberta (+12%) and Saskatchewan (+9%) were up significantly year-over-year in January, while Manitoba (+1%) and British Columbia (+1%) saw marginal gains.