Canada’s construction outlook has strengthened from last year and with that strength will come increased labour market demand over both the short and long term, according to BuildForce Canada’s 2020–2029 Construction and Maintenance Looking Forward national report. The report forecasts that employment in Canada’s construction and maintenance industry will grow by 50,200 workers by 2029. When combined with the anticipated retirement of more than 257,000 construction workers over the decade, the industry will need to recruit more than 307,000 workers just to keep pace with expected demand.

The most significant period of anticipated growth is almost here — expected to occur between 2020 and 2021. The associated labour force demand will be driven by a variety of projects, including major public transportation and infrastructure projects, and utility, liquefied natural gas (LNG), pipeline, and health services construction. New-housing construction is also expected to recover in most provinces. While the labour market scenario predicts that growth will slow toward the end of the decade, labour market challenges will be amplified as the wave of age-related retirements intensifies, and the pool of available young workers shrinks.

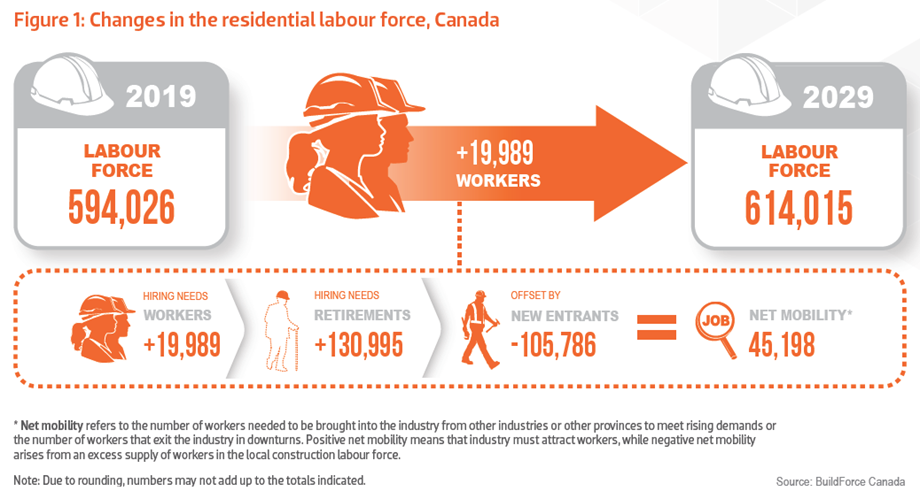

In the national residential sector, immigration-driven population growth is anticipated to support high levels of new homebuilding through 2026. However, as Canadians continue to retire in greater numbers, demand for new-home construction may soften, even as renovation and maintenance requirements rise. Residential construction employment is expected to grow by 17,200 workers over the 2020–2029 period.

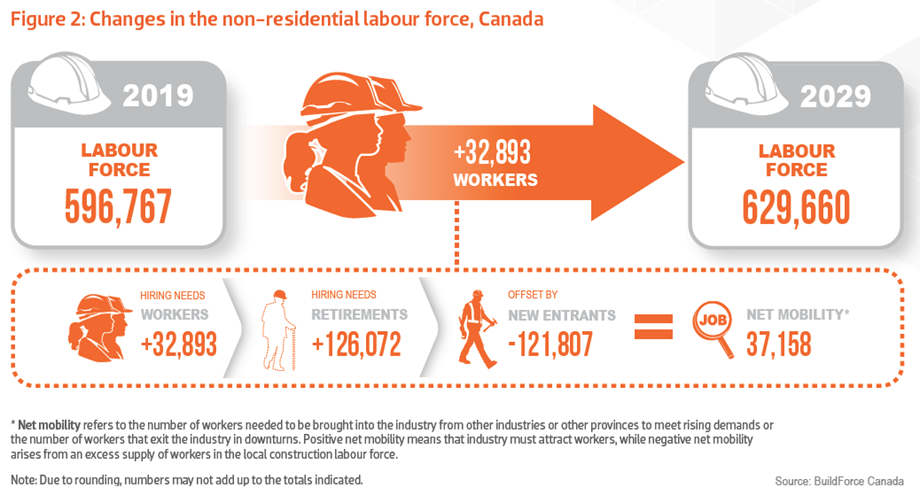

Non-residential employment demands are also expected to intensify, driven by major projects in the energy and utilities sectors, public transportation, and other institutional infrastructure work. Growth in retail and wholesale trade, the transportation and warehousing sectors, and manufacturing should boost construction of industrial buildings, as immigration-driven population growth inspires more commercial and institutional construction. Non-residential construction employment is expected to rise by 33,100 workers over the forecast period.

Strong construction markets in British Columbia, Ontario, Quebec, Prince Edward Island, and Nova Scotia are expected to drive national labour market demand over the short term. However, the intensity of demand in BC and Ontario through 2021 will place a premium on interprovincial mobility, as the skills of workers in provinces with softening markets will be in high demand.

Historical trends indicate that an estimated 227,600 first-time new entrants aged 30 and younger could be available from the local population to counterbalance retirements across the decade — but even full mobilization of those young workers would still leave a retirement-recruitment gap of 29,500.

As peak levels of construction activity normalize, the industry has an opportunity to use a pause in historic levels of labour demand to accelerate efforts focused on recruitment, training, and apprenticeship programs. Those efforts will help to ensure that skilled workers are available to meet long-term labour force demand, even as record numbers of older workers retire.

-----------

* See all the 2020–2029 Construction and Maintenance Looking Forward reports at www.buildforce.ca/en/lmi/forecast-summary-reports.