Part 4 of 5 – BuildForce Canada’s 2024 Construction Sector Insights

In this five-part series, BuildForce Canada presents and examines some of the key data points emerging from the past 12 months in the construction sector. In this post, the fourth of the series, we explore the labour market dynamics that shaped construction activity across Canada in 2024.

Canada’s construction labour markets navigated a subtle but important transition in 2024. After several years of extraordinary tightness fueled by rapid economic recovery and surging project demand, the industry saw labour conditions start to somewhat normalize. Employment edged higher, the workforce grew, and while the unemployment rate ticked up slightly, it remained well below historical averages.

For construction employers, project managers, and training organizations, these shifts may be a welcome sign. They point to an industry that is stabilizing after a period of intense stress, one where increased recruiting efforts are starting to pay off, and where labour supply is gradually expanding to meet persistently strong demand, particularly in the non-residential sector.

Steady employment growth, despite diverging trends

Construction employment across Canada reached 1.607 million workers in 2024, marking a modest 0.4% increase over 2023. This slight growth reflected the push and pull between a still-booming non-residential sector and a cooling residential market in some provinces – especially Ontario.

The construction labour force (i.e., the total number of people either working or actively seeking work) also grew, rising from 1.69 million to 1.702 million. This 0.7% increase suggests that recruitment efforts are succeeding in attracting new talent, a critical development for an industry facing long-term demographic pressures from an aging workforce.

As a result of the growing labour force, the construction unemployment rate edged up slightly, from 5.3% in 2023 to 5.6% in 2024. However, it is important to understand this slight increase is not a signal of weakening demand. In fact, it reflects a healthier, more sustainable balance between supply and demand for workers. Moreover, construction unemployment remains well below the 8.1% average recorded in the five years preceding the COVID-19 pandemic.

In short, today’s comparatively looser labour markets are still tight by historical standards – a critical context for workforce planners and employers seeking to fill growing labour needs.

Diverging provincial stories

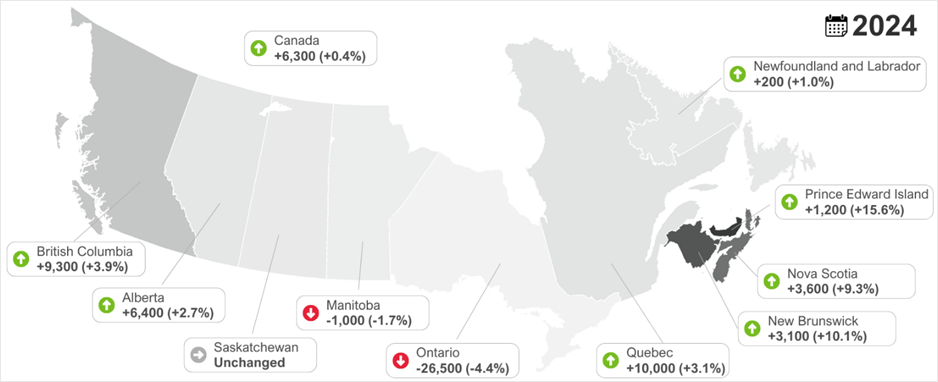

While Canada’s overall construction employment picture was stable, provincial stories diverged significantly. Ontario’s slowdown in residential construction weighed heavily on national trends, but many other provinces experienced strong employment gains.

- In Ontario, construction employment declined by 4.4%, primarily due to continued pullbacks in new-home construction and renovation activities.

- Construction employment increased by 15.6% in Prince Edward Island.

- In New Brunswick, construction employment rose by 10.1%

- Nova Scotia saw gains of 9.3% in construction employment.

- British Columbia, Quebec, Alberta, and Newfoundland and Labrador posted gains of between 1% and 4%.

- In Saskatchewan employment was flat.

- Manitoba was the only other province to record a decline (-1.7%).

Change in construction employment, by province, 2024

Source: Statistics Canada. Table 14-10-0023-01 Labour force characteristics by industry, annual (x 1,000)

These regional differences underscore the need for localized workforce strategies, especially as a larger portion of activity has been driven by the construction of institutional, government, and commercial buildings, along with other public infrastructure. While heavy industrial engineering construction has traditionally recruited at a national scale, project delivery of these types of projects hinge on labour availability at the provincial, and increasingly, local level.

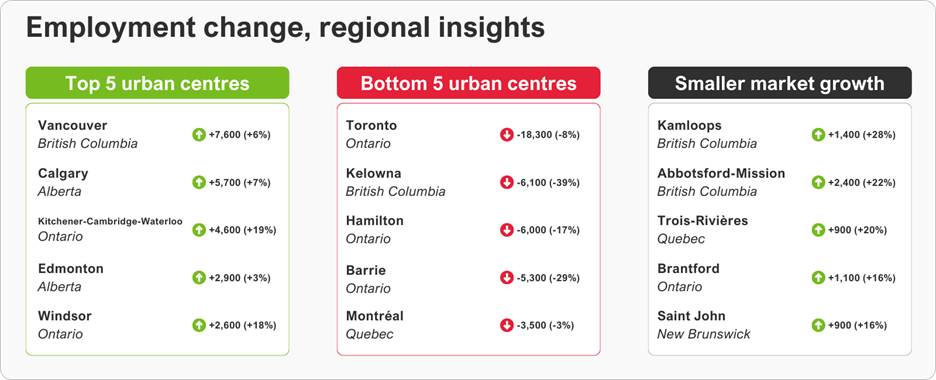

Regional spotlight: where labour markets shifted in 2024

While national and provincial averages offer a broad picture, much of the labour market dynamics in 2024 unfolded region-by-region. The contrasts were stark.

Understanding these regional differences has become increasingly important given the shift in the types of construction work being undertaken recently – with many more major projects related to public infrastructure and local buildings.

The following section peels back regional differences across Canada’s provinces. While we try to capture as much detail as possible, this analysis is limited by the availability of granular data by Statistics Canada’s Labour Force Survey.

- In British Columbia, construction employment grew rapidly in many regions, driven by major infrastructure and institutional projects. The Kamloops economic region led the country with growth of 27.5%, buoyed by work major healthcare facilities. Abbotsford-Mission also posted gains of over 20%, with Chilliwack (+14.5%) and Vancouver (+6.3%) also seeing increases. However, not all areas shared in the boom: Nanaimo saw employment contract by 16.7%, and Kelowna experienced a decline of 39.6%, reflecting the unevenness of project activity across the province.

- In Alberta, construction employment expanded across every major economic region. Lethbridge saw employment surge by 12.3%, supported by residential growth and infrastructure projects. Red Deer followed at 8.2%. Calgary posted the province’s largest real employment gain, adding 5,700 workers (+6.9%), while Edmonton added 2,900 workers, supported by non-residential activity and a recovering new-housing sector.

- Saskatchewan saw mixed results. Gains in the Saskatoon region were offset by declines in Regina, leaving overall provincial employment largely unchanged.

- In Manitoba, the Winnipeg region, which dominates the province’s construction market, saw a slight employment decline of 0.9%. This accounted for about 30% of Manitoba’s overall construction employment loss in 2024.

Change in construction employment, select regions, 2024

Source: Statistics Canada. Labour Force Survey custom data request.

- Ontario presented the most complex regional story. Some regions posted extraordinary employment growth: Kitchener-Cambridge-Waterloo (+19.0%), Windsor (+18.3%), and Brantford (+16.4%) led the way, buoyed by public infrastructure and manufacturing investments. However, these gains were overshadowed by widespread declines elsewhere. Toronto alone shed 18,300 construction jobs in 2024, a drop of 8.1%, largely tied to weaker new-home construction. Barrie (-29.3%), Peterborough (-21.5%), and Hamilton (-16.5%) also saw steep employment contractions.

- In Quebec, declines in major centres like Drummondville (-17.0%), Québec City (-6.2%), and Montréal (-2.5%) were partially offset by strong gains in Trois-Rivières (+19.6%), Saguenay (+8.5%), and Sherbrooke (+4.7%). Still, in real numbers, the declines in the urban regions outweighed the gains in other economic regions tracked by Statistics Canada. However, the fact that province-wide employment increased suggests that growth outside of economic regions tracked by Statistics Canada was strong.

- The Atlantic provinces fared well in 2024.

- New Brunswick enjoyed strong, broad-based growth, with Saint John and Moncton each posting employment increases of more than 15%.

- Nova Scotia’s Halifax region grew by 10.5%, accounting for nearly two-thirds of the province’s total construction employment gains.

- In Newfoundland and Labrador, growth was concentrated in St. John’s (+13.7%), while elsewhere employment was more stable.

- Data for Prince Edward Island remains unavailable due to population size.

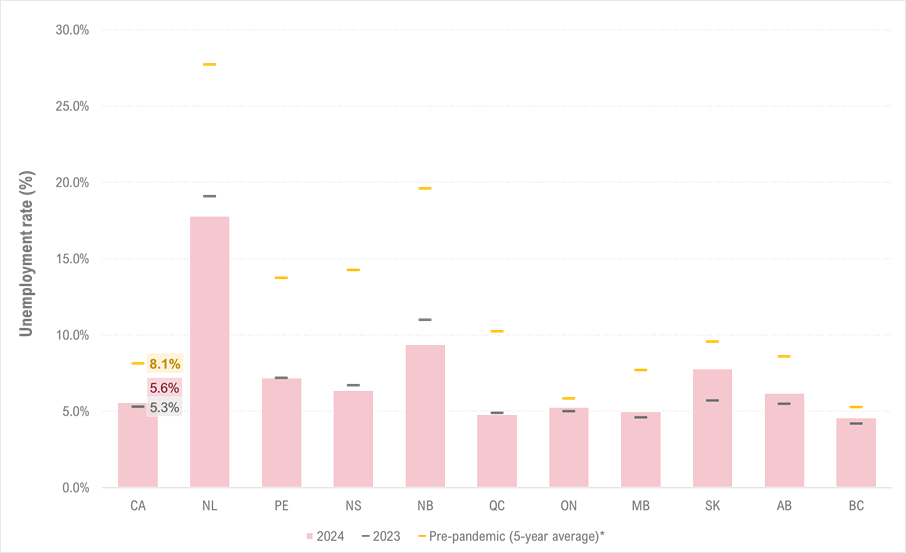

A healthy rebalancing in unemployment rates

Across Canada, the average construction unemployment rate of 5.6% in 2024 remains remarkably low compared to historical norms.

The slight increase in Canda’s construction unemployment rates – from 5.3% to 5.6% – was mirrored by several key provinces, including Ontario, Manitoba, Alberta, Saskatchewan, and British Columbia.

Unemployment rate in the construction industry, by province

Comparison of construction unemployment rates by province, 2024 versus 2023 versus pre-pandemic

* Pre-pandemic (5-year average) refers to the 5 years preceding the COVID-19 pandemic (i.e., 2015–2019)

Source: Statistics Canada. Table 14-10-0022-01 Labour force characteristics by industry, monthly, unadjusted for seasonality (x 1,000)

Meanwhile, the Atlantic provinces experienced even tighter labour market conditions, with unemployment rates eighter stable or declining.

Importantly, every province recorded unemployment rates well below their pre-pandemic five-year averages, highlighting that construction labour markets, even with slight easing, remain exceptionally strong.

The slight rise in construction unemployment rates, in a context of recent lows, offers much-needed breathing room for project delivery and workforce development. Project schedules, which have been strained in recent years, could see some improvements.

But make no mistake, on the back of the strength of the country’s non-residential sector, construction labour markets remain tight by any historical standards.

What it means for construction stakeholders

The construction labour market in 2024 was not cooling – it was normalizing. A slightly larger labour pool, combined with strong ongoing investment in infrastructure and non-residential projects, offered the industry a chance to regroup.

For employers, it means potentially better recruitment potential, but competition for skilled trades remains intense. It also means that training and upskilling programs remain vital to meeting evolving project demands, and just as important that regional workforce planning is critical, as growth and slack are highly localized.

Meanwhile, for policymakers and industry organizations, 2024 confirmed the need to keep investing in workforce development, even as migration patterns shift and domestic training efforts accelerate.

In the final instalment of this series, scheduled for release in September, we turn to an equally critical dimension of Canada’s construction future: workforce development. How did representation among women, Indigenous Peoples, immigrants, and young workers evolve in 2024? And what do apprenticeship trends reveal about building the next generation of skilled tradespeople?

For more information about these and other trends, click through to our 2025 to 2034 Construction and Maintenance Looking Forward highlight reports.

Construction Key Indicators