In this five-part series, BuildForce Canada presents and examines some of the key data points emerging from the past 12 months in the construction sector. In this post, the first of the series, we explore economic and demographic trends that reshaped the terrain for builders, developers, and policymakers alike. Later posts will look at outcomes in the residential and non-residential sectors, and on the labour force.

After years of volatility marked by pandemic recovery, rising inflation, and historic labour market shifts, 2024 was a year of transition for Canada’s construction industry. While some segments regained their footing, others felt the pressure of shifting policy, slowing economic growth, and demographic realignments.

BuildForce Canada closely monitors these macroeconomic and demographic forces as early signals of change that can ripple across investment cycles, project pipelines, and workforce planning.

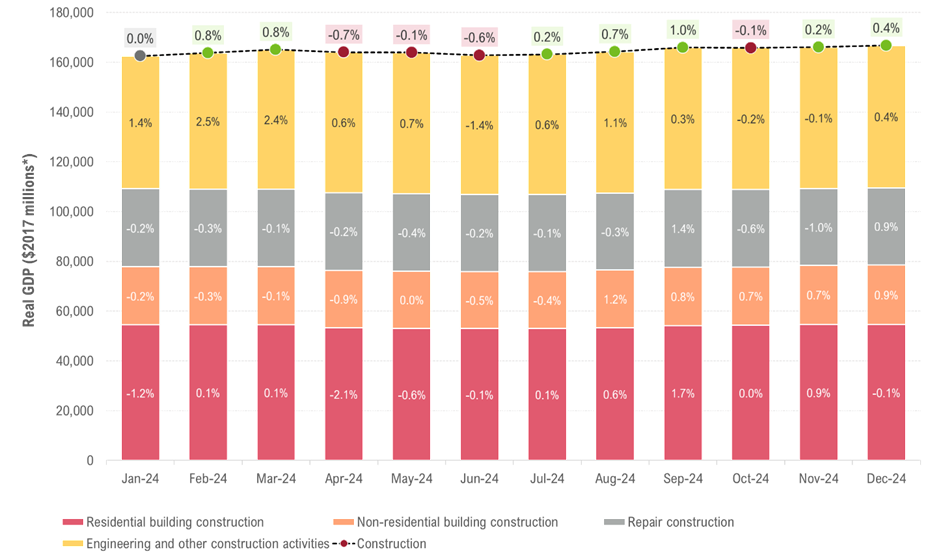

A year of modest decline for construction GDP

Construction GDP, which is a key indicator of industry output, ended the year at $164.5 billion, a slight decline of 0.3% from 2023. Although this change appears modest, underlying it is a complex realignment of sectoral activity.

For construction leaders and workforce planners, GDP movements reflect where demand is rising, where investment is flowing, and where capacity may need to shift. In 2024, the story wasn’t uniform.

The residential construction sector faced an uneven year. Early 2024 was marked by a continued decline in new-housing construction in Ontario, British Columbia, and Saskatchewan. These slowdowns pulled GDP in the sector lower in the first seven months, reflecting both affordability challenges and caution among land developers. Although activity rebounded in the latter half of the year – thanks in part to improving borrowing conditions – the sector still closed the year 1.6% below 2023 GDP levels. This decline in residential activity in 2024 is important to the overall construction industry as the segment is a key driver of overall industry employment and investment demands. A slowdown here can have cascading effects across the industry.

In contrast, non-residential building construction gained momentum. After a slower start to the year, investment in large-scale institutional projects, particularly in health care and education, helped the sector post year-over-year growth of 2.2%. For construction firms, this shift likely required realigning resources and workforce availability to meet growing demand for public infrastructure.

Repair construction, which typically provides a more stable base of activity, experienced a steady decline in 2024. GDP in this segment fell by 1.3% (year-over-year), as some homeowners and property managers deferred maintenance in the face of higher costs and economic uncertainty.

Activity in engineering construction saw a modest improvement over 2023. But, while activity saw a recovery after a steep mid-2023 downturn, it never fully regained its previous highs, as some major infrastructure projects began winding down while others may have been delayed or scaled back.

Each of these movements signals a directional change for companies operating across Canada’s diverse construction markets. Strategic decisions from hiring and training to capital investment, will depend on how each segment reacts to shifting economics in 2025 and beyond.

Construction industry real GDP, Canada, monthly

Construction real GDP in constant (2017) dollars and year-over-year percentage changes (%)

* $2017 billions indicates that the investment values are in year 2017 dollars (base year), that is, adjusted for inflation. This is used to calculate the real physical year-to-year change of the value of construction, factoring out growth (increase in value) due to increases in prices.

Source: Statistics Canada. Table 36-10-0434-01 Gross domestic product (GDP) at basic prices, by industry, monthly (x 1,000,000)

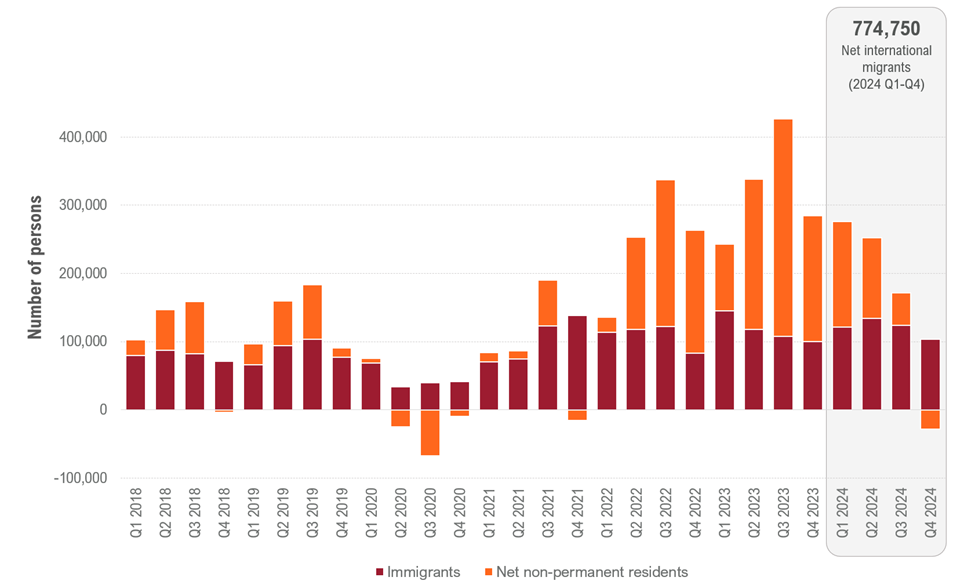

Federal policies impact international migration

Canada’s population growth is largely supported by immigration. With a natural population increase that remains low due to an aging demographic, the construction industry is especially sensitive to changes in the country’s immigration patterns. More people arriving in Canada means greater demands for housing, schools, transit, and infrastructure to support expanding communities.

In 2023, Canada saw record inflows of newcomers, especially non-permanent residents such as international students and temporary foreign workers. But 2024 marked the beginning of a shift. Federal policy changes intended to manage pressure on housing and social systems led to a dramatic slowdown.

Components of international migration, Canada, quarterly

Number of permanent and non-permanent immigrants

Source: Statistics Canada. Table 17-10-0040-01 Estimates of the components of international migration, quarterly

By the third quarter of 2024, the net number of non-permanent residents had dropped by 85% compared to the same period in 2023. And by year-end, Canada had a net outflow of these residents. For the entire year, the number of non-permanent residents dropped to just over 291,000, compared to nearly 821,000 the year prior.

Meanwhile, permanent immigration started the year slowly but picked up steam through the latter half. Canada ended 2024 with 483,600 net new permanent residents, a modest increase from 2023 (+2%).

For construction stakeholders, these changes in immigration policies have a real impact on future demands. A cooling in population growth, particularly from non-permanent sources, tempers the urgency for new housing and tends to slow the pace of commercial and infrastructure development.

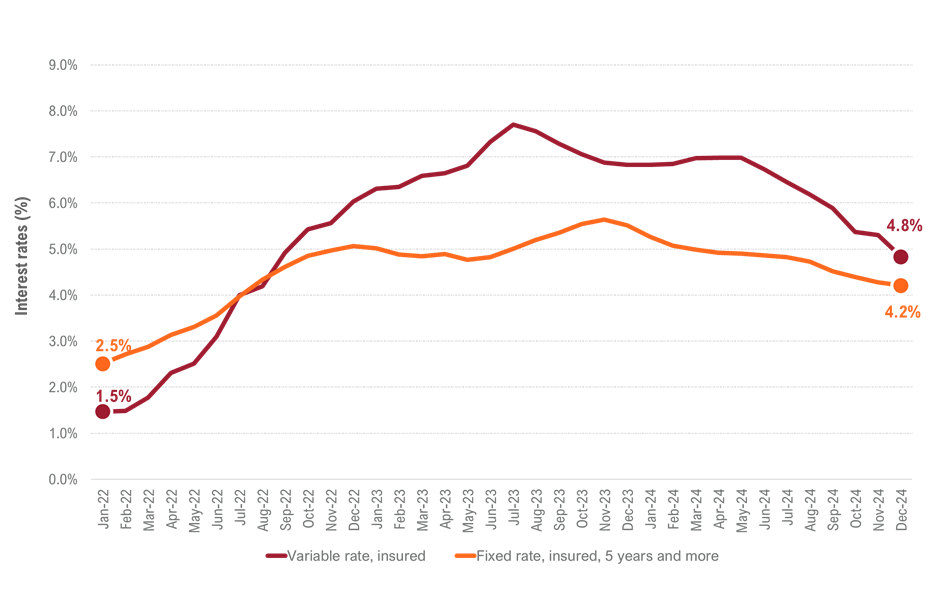

Declining interest rates were a welcome shift

Of all the macroeconomic levers that affect Canada’s construction industry, interest rates tend to have an overarching impact. Following aggressive rate hikes in 2022 and 2023 – meant to tame inflation – the Bank of Canada pivoted in 2024, introducing a series of rate cuts that gradually eased borrowing conditions for households and businesses.

This shift was especially impactful in the mortgage market. Variable rates, which had peaked at 7.7% in July 2023, dropped to 4.8% by the end of 2024. Meanwhile, the fixed five-year insured mortgage rate declined from 5.6% to 4.2% over the same period.

Interest rates for residential mortgages, Canada, monthly

Fixed and variable residential mortgage rates

Source: Statistics Canada. Table 10-10-0006-01 Funds advanced, outstanding balances, and interest rates for new and existing lending, Bank of Canada

For homebuyers, these changes improved affordability and mortgage qualification. For developers and homebuilders, they signaled renewed demand and project viability. Indeed, the second half of 2024 saw a noticeable uptick in residential construction activity, particularly in urban and fast-growing suburban regions.

Declining interest rates are also likely to have an impact on non-residential construction projects. Lower interest rates tend to reduce the cost of financing for large-scale infrastructure and institutional projects, potentially unlocking stalled developments or enabling new ones to break ground.

Reading the signals

For Canada’s construction industry, 2024 was a year of deceleration in some areas and reacceleration in others.

These macroeconomic currents shape demand for infrastructure, the viability of projects, and the urgency of workforce development. They determine where cranes rise, where permits are filed, and where training is most urgently needed.

In the next part of our series, we’ll zoom in on one of the most watched areas of Canada’s construction sector: residential construction.

For more information about these trends, click through to our 2025 to 2034 Construction and Maintenance Looking Forward highlight reports. And watch for part two of this blog series, scheduled for release in June, where we look at how housing demands have been shaped by rising interest rates.

Construction Key Indicators