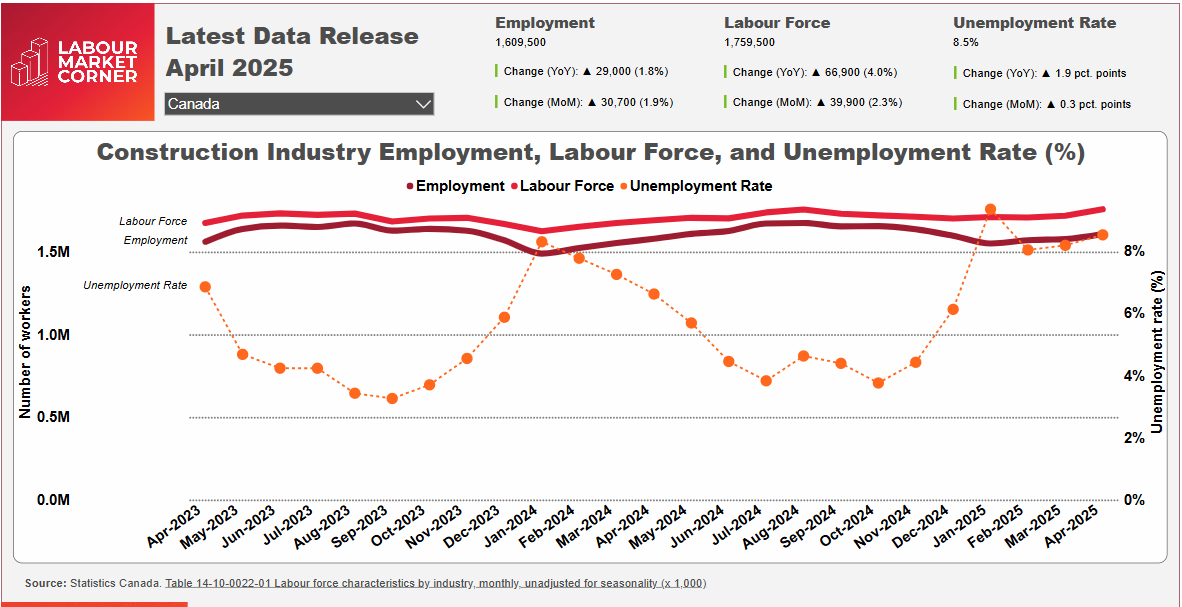

The latest Labour Force Survey data from Statistics Canada, for April 2025, finds construction unemployment levels at one of their highest levels since the COVID-19 pandemic.

The survey data shows that construction employment levels have risen by 1.8% (+28,900 workers) over the 12-month period ending in April 2025. Meanwhile, the construction labour force grew by 4%, or by 66,900 workers, over the same period. These trends combined to elevate unemployment in the sector by nearly two full percentage points, from 6.6% in April 2024 to 8.5% in April 2025. That rate is the second highest on record since the end of the pandemic in 2022, exceeded only by the rate of 9.3% reported in January 2025.

Uncertain market conditions in Ontario in April 2025 raised national construction unemployment rates compared to the same month in 2024. This was due to a large increase in the number of job seekers in the province’s construction industry. The growth of 23,100 (+4.3%) workers in Ontario’s construction labour force (employed and unemployed) came at a time when market uncertainty continued to bring employment levels lower (-5,400 workers; -0.9%).

The increase in Ontario’s construction labour force may be due to political turmoil, which has caused employment to retreat across several key industries including manufacturing (-4.5%), wholesale trade (-12%), and transportation and warehousing (-8.2%). This decline – in industries where workers possess transferrable skills to the construction industry – may be driving workers from these industries to seek employment in the province’s construction industry.

This dramatic disconnect between labour force and employment trends in Ontario skew national numbers and give a false impression of looser labour markets nationally – which is not the case. In fact, absent of Ontario’s large labour force growth, Canada’s construction labour force would have grown in line with employment in April.

This trend should not be cause for immediate alarm, and may suggest employment levels are returning to levels that are more typical for the industry at this time of year. For context, excluding the pandemic years of 2019 to 2021, this most recent unemployment figure for the month of April is more in keeping with average of rates seen for the month of April for the five-year period of 2014 to 2018, which was 11.2%.

The rising trend in unemployment may be driven by a combination of factors, including continued slow growth in new residential construction activity that itself has been driven by market uncertainty created by the ongoing tariff dispute between the United States and Canada, as well as elevated levels of unsold inventory, particularly among condominium units in several major urban centres, including the Greater Toronto Area.

Tariff uncertainty may also be driving a slowdown in non-residential construction activity, and in particular among projects in the industrial and commercial sectors, which are principally driven by consumer demand, and funded by the private sector. Major projects already underway in the government and institutional sectors are unlikely to have been affected by market uncertainty.

April’s labour market trends combined to erase some of the gains in employment made among women and young workers. Unemployment among all workers aged 15 to 24 years increased from 7.9% in April 2024 to 12% in April 2025, with employment and labour force figures among young women in particular contracting. Among young men, a significant increase in the labour force outpaced growth in employment. Employment and labour force figures among all women also declined over the past 12 months, with drops of 4.8% and 3.7%, respectively.

Construction employment gains across the provinces were greatest in Western Canada, with British Columbia (5.2%), Alberta (9.8%), Saskatchewan (12.6%), and Manitoba (2.4%) all reporting year-over-year gains. Among Central and Atlantic Canada, only Prince Edward Island reported an employment gain compared to April 2024, at 13.7%. Employment contractions in the other provinces varied from -0.7% in Quebec to -15.4% in New Brunswick.

Four provinces reported unemployment rates in the double digits, with Newfoundland and Labrador reporting a rate of 23.6%, New Brunswick reporting a rate of 17.4%, Nova Scotia 10.3%, and Ontario 10.1%. The lowest rates were reported in British Columbia at 4.4% and Prince Edward Island at 5.2%.

Construction Key Indicators