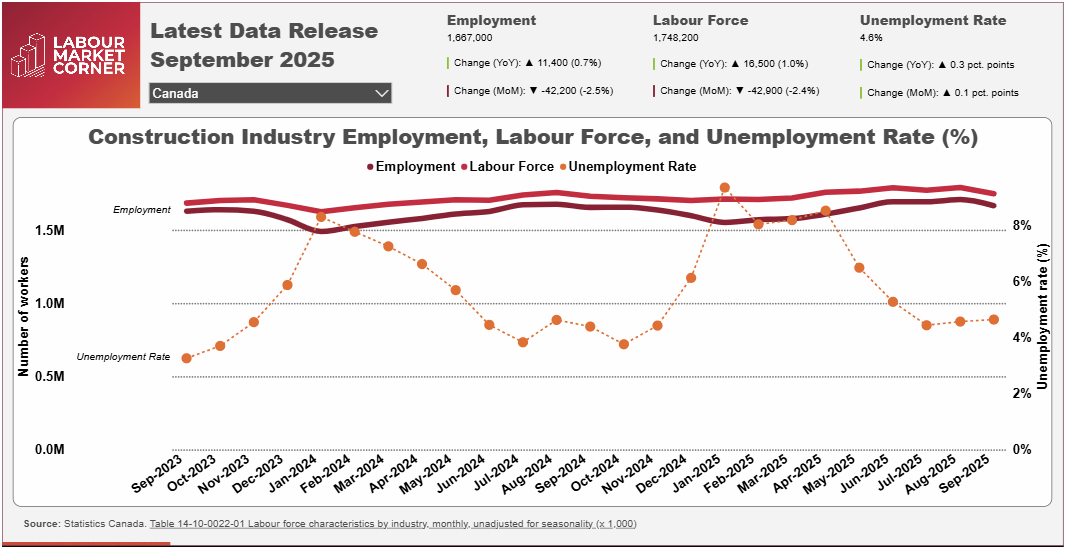

The latest data from Statistics Canada’s Labour Force Survey – for September 2025 – finds the construction industry’s employment and labour force numbers both slightly higher than a year ago.

Growth of 16,500 workers, or 0.9%, in the labour force outpaced an increase of 11,400 workers, or 0.7%, in employment. As a result, the industry’s unemployment rate edged up by 0.3 percentage points – to 4.6% – compared to a year ago.

A closer look at the data finds employment gains over the year limited to the male cohort. Employment among men in the industry rose by 16,100 workers, or 1.1%. Notably, the youngest male cohort – i.e., those aged 15 to 24 years – saw the greatest absolute gain in employment over the last 12 months, adding 9,600 workers, or 5.2% compared to September 2024. Employment among core-aged male workers – i.e., those aged 25 to 54 years – added 6,500 workers, or 0.7% over the same period.

Employment among women in the industry contracted by 4,700 workers, or -2.2% over the last 12 months. The losses were greatest among workers aged 55 years and over (-8,900, -17.3%), while employment among the youngest cohort of women contracted by 1,200 workers, or -5.8%. More encouraging was growth among core-aged women, where employment added 5,500 workers, or 3.8%.

Across the provinces, British Columbia reported the greatest employment gain over the past 12 months, with the industry adding 16,900 workers, or 6.8%. Also noteworthy were gains in employment in Alberta (+8,900 workers, 3.6%) and Manitoba (+4,600 workers, 7.7%). The gain in employment in British Columbia mirrors an increase in the total value of building permits (+35%) issued for the 12-month period ending in August 2025. In particular, the province is showing strong activity in the institutional sector (+98%) over the last 12 months, due in large part to ongoing work on hospital projects in Vancouver, Surrey and Burnaby. Commercial-sector construction activity, too, is significantly ahead (+104%) of last year’s pace, as are housing starts (+43%).

Although aggregate permit values in Alberta for the 12-month period ending in August 2025 are 23% lower than in August 2024, employment gains in the province are likely due to significant growth in the province’s institutional construction sector. Permit values there are 166% higher than a year ago. Moreover, the province continued to see gains in the construction of apartment housing units. Manitoba, meanwhile, is reporting significant gains in permit values across the institutional (+760%) and commercial (+118%) construction sectors, as well as growth of 23% in housing starts from August 2024 to August 2025.

Five provinces recorded employment contractions over the same period, with Quebec (-19,100, -5.4%) accounting for by far the greatest pull back. New Brunswick (-1,800, -5.0%), Prince Edward Island (-1,100, -10.5%), Ontario (-1,000, -0.2%), and Newfoundland and Labrador (-200, -1.0%) reported smaller absolute employment contractions.

The value of building permits issued in Quebec over the 12-month period ending in August 2025 was just under 5% lower than a year previous, with declines in permits for multi-unit residential dwellings (-22%) and institutional buildings (-7%) offsetting gains in the other three building components (industrial, commercial, and single-dwelling residential buildings). Although housing starts in the province were approximately 8% higher in August 2025 than in August 2024, starts for more labour-intensive single-detached (-4%) and semi-detached (-30%) units were notably lower over the year.

Three of the other four provinces reporting employment contractions (i.e., New Brunswick, Ontario, and Newfoundland and Labrador) also reported lower building permit values and fewer housing starts across the 12-month period ending in August 2025. Although Prince Edward Island reported gains in both permit values and housing starts across the same period, the employment contraction in the province is likely due to work winding down on two key institutional-building projects in Charlottetown: the Province House refit and the UPEI medical school building.

Finally, construction unemployment rates across the provinces varied from a low of 2.0% in Manitoba to a high of 10.2% in Newfoundland and Labrador. Most other provinces reported rates of between 3.1% and 4.9%.

Construction Key Indicators