In this five-part series, BuildForce Canada presents and examines some of the key data points emerging from the past 12 months in the construction sector. In this post, the third of the series, we examine the non-residential construction trends that defined the year, including record-breaking major project investments and the rising importance of infrastructure in Canada’s construction economy.

While Canada’s residential construction spent much of 2024 regaining its momentum, the nation’s non-residential sector hit the gas pedal. From coast to coast to coast, institutional investments, industrial megaprojects, and infrastructure upgrades helped sustain a red-hot pace of construction.

For construction firms, project owners, and tradespeople alike, 2024 reaffirmed the vital role of non-residential activity in driving economic momentum and in anchoring employment and investment even amid housing market uncertainty.

A sector full of throttle

By nearly every measure, non-residential construction in 2024 was firing on all cylinders. The sector saw widespread activity across both large-scale and smaller projects, pushing investment to new heights.

BuildForce Canada tracked a record-setting 464 major projects, which combined contributed over $42.3 billion (in 2017 constant dollars) to overall non-residential investment in 2024. While these megaprojects often attract the spotlight, it’s important to recognize that they represent just one-quarter of overall non-residential investment. The lion’s share of activity came from smaller infrastructure and institutional projects, which were equally dynamic throughout the year.

Much of the year’s strength came from construction in the health, education, and public safety sectors, as governments across the country ramped up investments in aging facilities and growing community needs. Commercial construction, by comparison, remained more muted, reflecting shifting retail and office demand post-pandemic.

Infrastructure investments hold strong

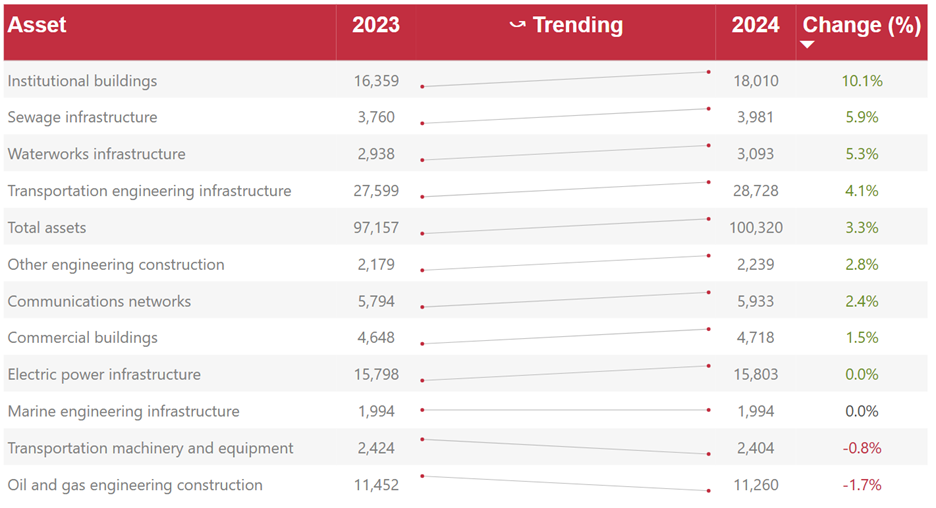

Public and private infrastructure spending remained a cornerstone of Canada’s non-residential growth story in 2024. Investment in infrastructure rose by 3.3%, following a robust 5.8% gain in 2023. While many asset classes saw year-over-year increases, growth was strongest in areas aligned with public well-being and environmental sustainability.

Among the standout sectors:

- Health, education, and public safety infrastructure saw investment gains exceeding 10%.

- Water and sewage systems posted solid growth, with waterworks up 5.3% and sewage infrastructure up 5.9%.

- Transportation engineering infrastructure expanded by 4.1%, supporting long-term connectivity and economic development.

Notably, investment cooled in some traditionally dominant areas, including oil and gas engineering infrastructure (pipelines) and commercial buildings, as well as machinery and equipment related to large-scale power generation. This shift signals an evolving focus in non-residential construction from extraction and industry toward sustainability, livability, and modernization, reflecting the recent surge in population growth and an aging infrastructure across the country.

Change in Infrastructure Investment by Asset Class, Canada, 2024

Note: Infrastructure investments in the table above are displayed in 2017 constant millions and are for all purchasing industries and all asset functions.

Source: Statistics Canada. Table 36-10-0608-01 Infrastructure Economic Accounts, investment and net stock by asset, industry, and asset function (x 1,000,000)

Major projects activity at record highs

While institutional and infrastructure investments formed the backbone of non-residential growth, 2024 also saw a remarkable slate of major projects that reshaped regional construction landscapes.

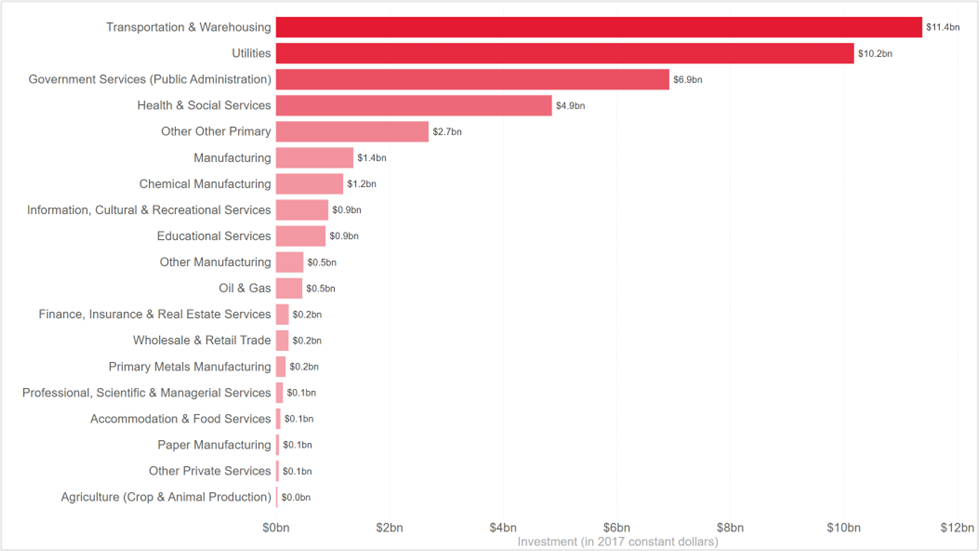

Nationally, the transportation and warehousing sector led the pack, accounting for $11.4 billion of major project investment (in 2017 constant dollars). The utilities sector followed closely, with $10.2 billion, including work on clean energy and transmission.

Key industrial and energy-related projects in 2024 included:

- LNG Canada (Phase 1) – Kitimat, BC

- Woodfibre LNG – Squamish, BC

- Peace River Site C Dam – Fort St. John, BC

- Darlington Nuclear Refurbishment – Darlington, ON

- Bruce Power Refurbishment – Bruce Township, ON

At the same time, public and institutional investments surged:

- Niagara Falls Hospital – Niagara Falls, Ontario

- Hôpital Vaudreuil-Soulanges – Vaudreuil-Dorion, Quebec

- Surrey Hospital – Surrey, British Columbia

- Centre Block Renovation (Parliament Hill) – Ottawa, Ontario

- Gordie Howe International Crossing – Windsor, Ontario

The manufacturing sector also experienced a revival, led by electric-vehicle-related and a major vaccine production facility, with multiple new construction and retooling projects concentrated across Ontario.

BuildForce Canada Major Projects Investment in 2024, by industry, Canada

Note: Major projects investment are displayed in 2017 constant dollars and they reflect the investments by industry for 2024 only (i.e., it is not the cumulative investments over the entire life of tracked major projects).

Source: BuildForce Canada

Regional spotlight: major projects across every corner

Across the provinces, non-residential investment in major projects reflected unique regional strengths and priorities:

- British Columbia: ~$10B in major-project-specific investments, led by LNG, Site C Dam, TMX pipeline, major hospitals, and water/sewer infrastructure.

- Alberta: ~$5B, driven by hydrogen energy complexes, major LRT systems, solar/wind farms, and key pipelines.

- Saskatchewan: ~$2B, with the Jansen mine, Aspen Power Station, Prince Albert hospital, and wind/water projects leading the way.

- Manitoba: ~$400M, focused on healthcare facilities, water treatment, and the St. Mary’s & Perimeter interchange project.

- Ontario: ~110 projects totaling ~$15B, across transit (Toronto and surrounding areas, Ottawa), nuclear refurbishment, hospitals, highways, and EV-related manufacturing facilities and retooling.

- Quebec: ~$7.5B, with investments in roads, highways, bridges, tunnels, hospitals, Hydro Quebec projects, and rail/airport improvements.

- New Brunswick: ~$423M, spanning new nursing homes, civil infrastructure, and cultural facilities across the province.

- Nova Scotia: ~$1.5B across 49 projects in utilities, health care (QEII Infirmary), wind energy, and post-secondary institutions.

- Newfoundland and Labrador: ~$870M, anchored by the West White Rose project and major road, education, and healthcare upgrades.

- Prince Edward Island: ~$270M, two-thirds in infrastructure – education, healthcare, roads – and notable wind and transmission work.

These investments speak not only to the scale of activity but also to the broadening geographic footprint of major non-residential construction. As smaller provinces accelerate their infrastructure development, and larger provinces double down on sustainability and modernization, labour demand is becoming increasingly dispersed, which is a critical consideration for workforce planning.

What the momentum means for stakeholders

The non-residential sector’s strength in 2024 confirms its critical role as an economic stabilizer. In a year where housing saw uneven recovery, non-residential construction anchored investment and employment. It also illustrated how construction priorities are evolving: toward resilient public infrastructure, clean energy, and next-generation manufacturing.

For industry stakeholders, this momentum signals both opportunity and complexity. Project timelines remain lengthy, permitting challenges persist, and the demand for skilled trades across civil, institutional, and energy construction is growing rapidly.

But the opportunity is enormous. With governments, private investors, and communities aligned on upgrading Canada’s infrastructure and energy systems, non-residential construction is poised to remain a pillar of growth in the years ahead.

For more information about these trends, click through to our 2025 to 2034 Construction and Maintenance Looking Forward highlight reports. And watch for part four of this blog series, scheduled for release in August, where we dive into how the pace of activity in both the residential and non-residential sectors shaped hiring, availability of workers, and employment conditions across Canada.

Construction Key Indicators