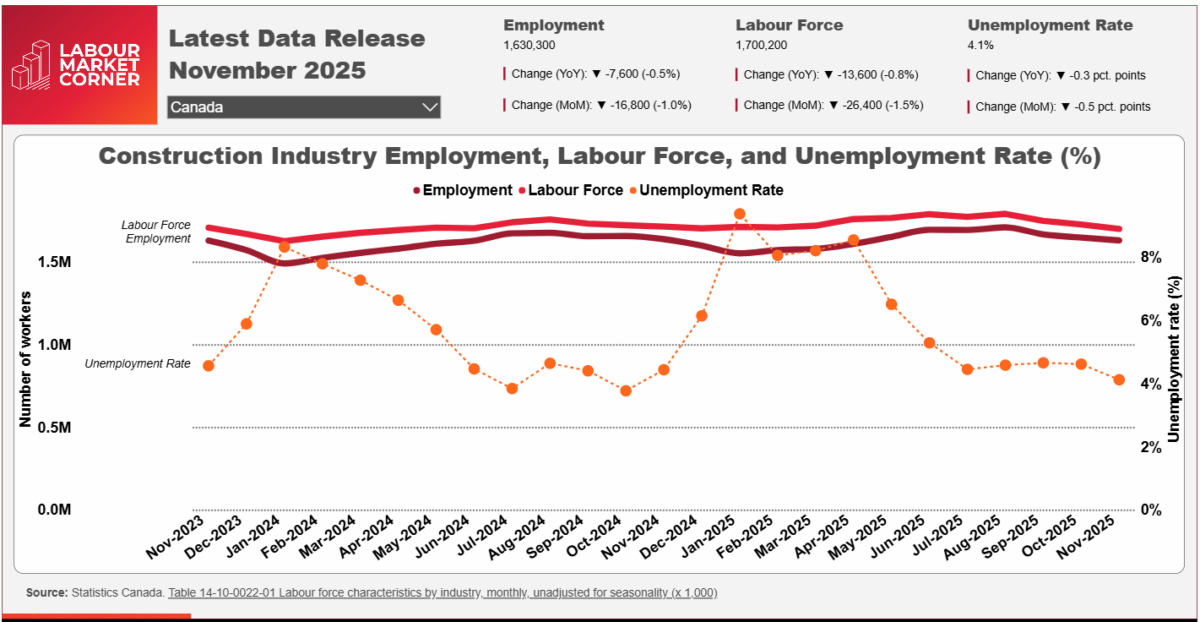

National construction employment metrics declined in November, with losses in the labour force exceeding those in employment over the past 12 months. Construction’s unemployment rate reached a 13-month low at 4.1%.

Construction employment, labour force and unemployment all declined in November as a contraction in the labour force (-13,600 workers, or -0.8%) was notably larger than a contraction in employment (-7,600 workers, -0.5%) when compared to data from November 2024. As a result, the national construction unemployment rate reached its lowest level in more than a year – at 4.1%.

Building permit data for the 12-month period ending in October 2025 finds a gain of 9.6% in overall construction activity that was driven by increases in both the residential (+8.4%) and non-residential (+11.7%) sectors. Although the former saw a decrease in permit values for single-family dwellings (-10.6%), that loss was more than offset by a gain in activity among multi-unit dwellings (+19.6%). Meanwhile, a notable gain in permit activity in the commercial-building component (+33.1%) drove the increase in non-residential construction.

A closer look at the data finds notable demographic trends. For the year ending November 2025, employment among the youngest worker demographic – i.e., those aged 15 to 24 years – was up by more than 10%, adding 19,100 workers. Gains were reported among both young men (+16,400 workers, +9.6%) and young women (+2,700 workers, +16.5%). Conversely, the last 12 months saw a significant contraction in employment (-23,000 workers, -7.1%) among those in the oldest age cohort – i.e., those aged 55 years and over.

Among core-aged workers (i.e., those aged 25 to 54 years), employment declined by 3,600 workers, or -0.3%, with losses exclusive to core-aged females (-5,500 workers, -3.5%).

Data from across the provinces finds employment gains exclusive to Western Canada. All four of British Columbia, Alberta, Saskatchewan, and Manitoba recorded employment increases over the past 12 months. British Columbia reported the greatest absolute gain at 6,600 workers (+2.6%), while Manitoba reported the largest relative gain at +10.2%. A series of major projects in all four provinces are likely responsible for these gains. Among them are upgrades to the North End Wastewater Treatment Plant biosolids facilities in Winnipeg, the 370-megawatt Aspen Power Station in Lanigan, Saskatchewan, Stage 1 of the Calgary Green Line LRT, and the Surrey Langley Skytrain in British Columbia.

Meanwhile, employment losses were consistent among Central and Atlantic Canada. Quebec (-18,500 workers, -5.4%) reported the greatest year-over-year contraction, while at -7.1%, Newfoundland and Labrador reported the largest relative employment contraction. Employment losses in Quebec are most likely the product of a number of major construction projects passing peak employment periods over the last 12 months – or concluding outright. Building permit data in the province for the year ending in October 2025 shows a significant contraction (-46.6%) in permit values for the province’s institutional and government sector. Notably, permit values in the province’s residential sector are elevated over the last 12 months, with gains in both the single- and multi-family dwelling components.

Across the provinces, and with the exception of Newfoundland and Labrador (15.3%), unemployment rates varied from a low of 2.2% in Saskatchewan to a high of 7.0% in Nova Scotia.

Construction Key Indicators