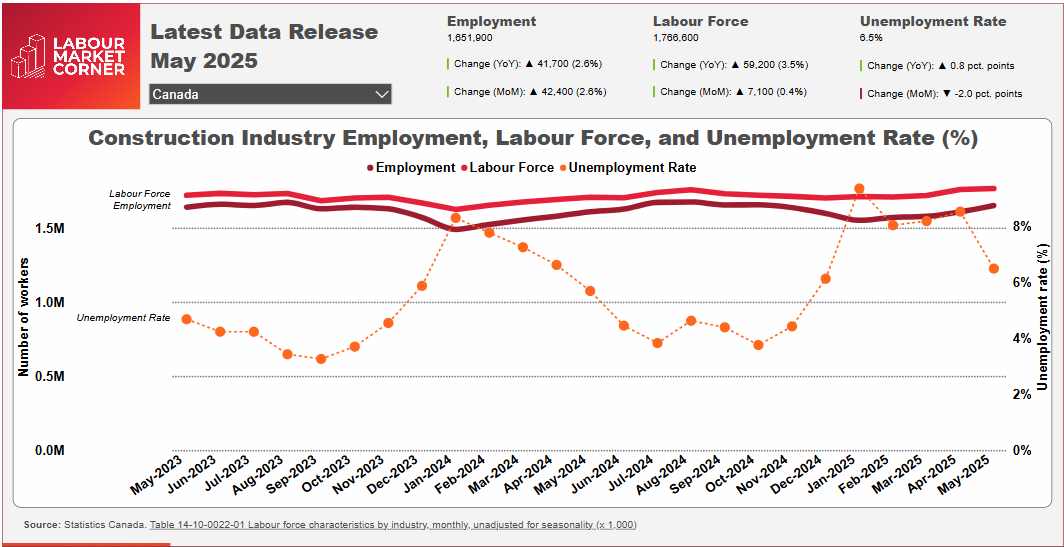

Construction unemployment continued its trend of returning to more normal levels in May.

The latest Labour Force Survey data from Statistics Canada finds the industry’s unemployment rate at 6.5% for the month. Although that figure is above the 5.7% rate posted in May 2024, it is much more closely aligned with the average rate for the month over the past seven years (6.8%), and approaches the pre-pandemic rates of 6.6% and 6.3% that were reported in May 2018 and May 2019, respectively.

The increase in industry unemployment has occurred as growth in the labour force outpaced employment growth. Over the 12-month period ending in May 2025, construction’s labour force grew by 3.5% (+59,100 workers) while employment increased by 2.6% (+41,900 workers).

At the national level, growth in employment opportunities is consistent with increasing construction of multi-family housing units, which in turn is supported by increased number and value of building permits through April, and by a stronger rise in apartment starts in April.

Construction activity, measured by the volume of building permits issued by Canadian municipalities, showed a notable contraction over the 12-month period ending in April 2025. Permit volumes were nearly 12% lower than a year ago, with contractions reported across all building types. Most notable among these were decreases of just under 13% in both single-dwelling housing buildings and institutional buildings, a drop of 15% in industrial building permits, and a drop of more than 11% in permit activity among commercial buildings.

Meanwhile, housing start volumes rose by 19% over the 12-month period ending in April 2025 with significant gains reported in the number of apartment units (+22%) and single-detached units (+17%).

Ontario continues to see construction levels retreat. The number of building permits for residential and non-residential construction issued in the province was nearly 19% lower for the 12-month period ending in April 2025. Permit volumes were notably lower in single-dwelling housing building construction (-25%), industrial building construction (-18%), and multi-unit dwelling housing construction (-14%).

Meanwhile, housing start volumes in Ontario were 7% lower for the year ending in April 2025. British Columbia, Manitoba, and New Brunswick were the only other provinces to also reported reductions in building permit and housing start activity over the 12-month period ending in April 2025.

The addition of some 59,100 workers to Canada’s construction labour force in May is almost exclusively achieved through a strong rise in the number of men in the core working age group (25 to 54 years). This may be indicative of trends happening elsewhere in the economy, where these men may have been displaced from employment opportunities such as in the oil and gas and manufacturing sectors.

May’s LFS shows contractions in almost every metric pertaining to women in the construction sector. Overall employment among women contracted by 5.7% over the past 12 months, while the female labour force shrunk by 6.3%. Among women aged between 15 and 24 years, employment contracted by 17.4% while the labour force contracted by 15.8%. Employment among core-aged women, i.e., those aged 25 to 54 years, was the only metric to increase over the past 12 months, adding 1.4%.

In contrast, employment metrics among men in the industry increased across almost all demographics. The youngest male cohort saw employment increase by 6.8% and the labour force add 6.7% over the last 12 months. Both metrics increased among core-aged males, while the eldest cohort (those aged 55 years and older) experienced slight contractions in both employment and the labour force.

Across the country, four provinces reported employment contractions between May 2024 and May 2025. Quebec recorded the largest actual decline at -19,800 workers or -5.9%, while Ontario reported a contraction of -11,800 workers or -2.0%. Newfoundland and Labrador reported a contraction of 2,300 workers, which is a smaller actual contraction compared to Ontario and Quebec but represents a significant decline of 11.4% for the province. New Brunswick reported a more modest contraction of -100 workers or -0.3%.

Among those provinces that recorded employment gains over the last 12 months, Alberta led the way with an increase of 34,500 workers, or 14.3%. British Columbia followed at +25,000 workers (+10.3%), while Saskatchewan reported a gain of 7,000 workers (+16.3%) and Manitoba recorded a gain of 6,300 (+11.2%). Nova Scotia reported a gain of 2,000 workers (+4.9%), while Prince Edward Island’s employment grew by 1,100 workers (+13.1%).

Finally, construction unemployment rates across the provinces varied from a high of 17.6% in Newfoundland and Labrador to a low of 4.4% in Saskatchewan. With the exception of Ontario at 8.5%, other provincial rates varied between 4.5% and 6.0%.

Construction Key Indicators