As construction transitions into its busy period of the year, the industry may be returning to more typical labour market conditions.

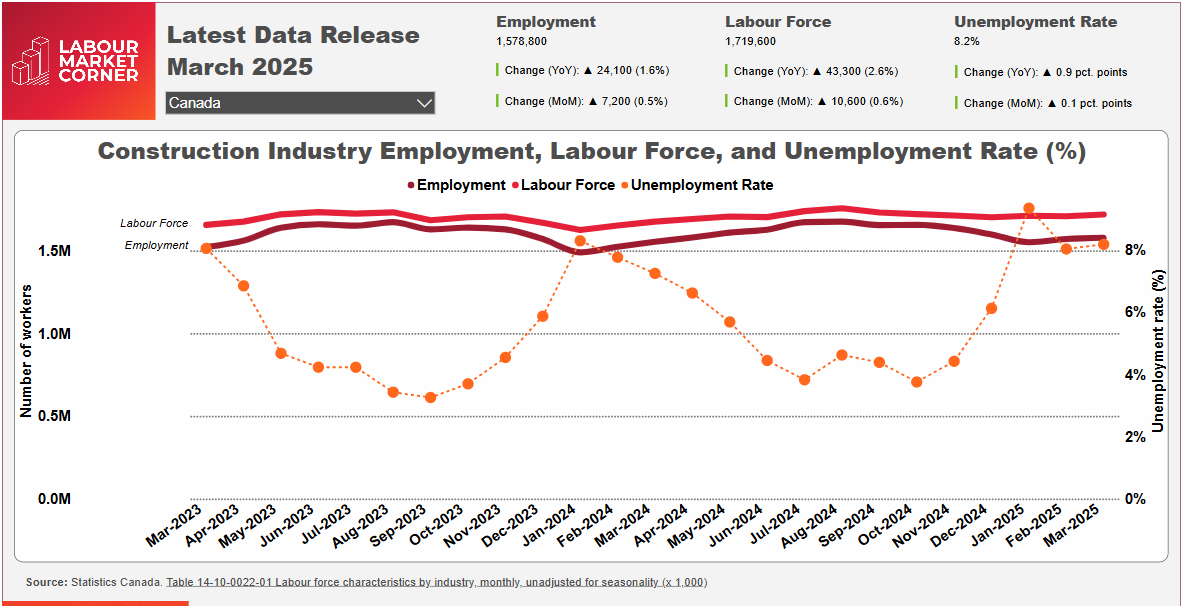

Data from the March 2025 Labour Force Survey finds several key metrics tracking higher over the past 12 months. Compared with March 2024, the industry’s labour force rose by 43,300 workers (2.6%), however, employment increased by only 24,300 (1.6%), which contributed to a year-over-year increase in the unemployment rate, increasing from 7.3% in March of 2024 to 8.2% in 2025.

The higher unemployment rate suggests the industry may be returning to more typical levels of activity, particularly compared with the extremely tight labour markets seen in recent years.

The value and number of residential building permits was up this past January (compared to January 2024), with notably stronger growth in multiple-dwelling buildings which follows the moderate growth seen since the federal government introduced a 100% GST rebate for purpose-built rental housing. This growth coincides with trends in housing starts, with Saskatchewan, Quebec, and Prince Edward Island in particular posting very strong growth for the year to date.

However, residential construction continues to be subdued in Ontario, which limits national growth for housing starts. New housing sales in the Greater Toronto Area were particularly muted, with the Building Industry and Land Development Association reporting year-over-year decline of 50% in February. Condominium sales were down by 62% from the same period last year, while single-detached units were down 38%.

Excluding the weakness in Ontario’s residential sector, declining interest rates should help spur on a modest recovery across the country. When combined with the continued strength in non-residential construction across Canada, the industry is poised for a stronger 2025 construction season.

The increase in the unemployment rate should be no cause for alarm. Even at levels above 8%, the March 2025 rate is in line with the five-year average for the month, and is notably below the 10-year average of 10% for the month.

A closer look at the increase in the labour force data shows significant growth among young workers aged 15 to 24 years. With a year-over-year growth of 14,400 workers, or 8%, this cohort accounted for more than one-third of the total labour force increase over the past 12 months, and more than offset a contraction of 10,600 workers among the cohort aged 55 years and older.

Labour force growth was also significant among young women (i.e., those aged 15 to 24 years), where it increased by more than 20% compared to a year ago. The youngest male cohort saw a smaller increase of 6.5%. Increases were more modest among both genders’ core-aged labour force (i.e., workers aged 25 to 54 years), while both genders’ eldest cohorts experienced labour force contractions.

Although the growth in Canada’s construction labour force has slightly outpaced employment growth, these trends are encouraging as they signal that the industry is having success at recruiting young workers and, in particular, those workers from traditionally underrepresented groups such as women. This growth is important for the industry to grapple with retirements and to build capacity for the industry to build the infrastructure the country desperately needs.

Employment gains were reported in five provinces over the past year, with the most notable increases reported in Alberta (25,800; 10.7%), British Columbia (15,100; 6.3%), and Saskatchewan (8,700; 24.2%). Ontario (-23,700; -4.1%) and Newfoundland and Labrador (-3,000; -16.9%) reported the largest year-over-year employment contractions.

Unemployment rates varied across the provinces from a low of 3.1% in British Columbia to a high of 26.7% in Newfoundland and Labrador. Most other provinces reported rates of between 9% and 11%.

Construction Key Indicators